Cost allocation is a process in which businesses and individuals identify the costs incurred by activity and distribute them to appropriate accounts. The fee need not relate to the cost of obtaining the asset; rather, it is a mechanism for managing demand. A company’s overheads have been allocated and apportioned to its five cost centres as shown below. When calculating unit costs under absorption costing principles each cost unit is charged with its direct costs and an appropriate share of the organisation’s total overheads (indirect costs). An appropriate share means an amount that reflects the time and effort that has gone into producing the cost unit. Now assume that the actual number of purchase orders completed during the period was 290 for the Cooking Department and 100 for the Canning Department.

- The support department with the highest percentage is allocated first.

- These differences are likely to besignificant in terms of evaluating the service department costs, particularly in cases where a “make or buy” (outsourcing) decision is involved.

- Cost allocation within a business entity should uphold certain principles for the process to be fair, efficient, and effective.

- A disadvantage of using the dual rate method is that idle capacity costs for theservice departments are allocated to the user departments.

Management Accounting: Concepts, Techniques & Controversial Issues

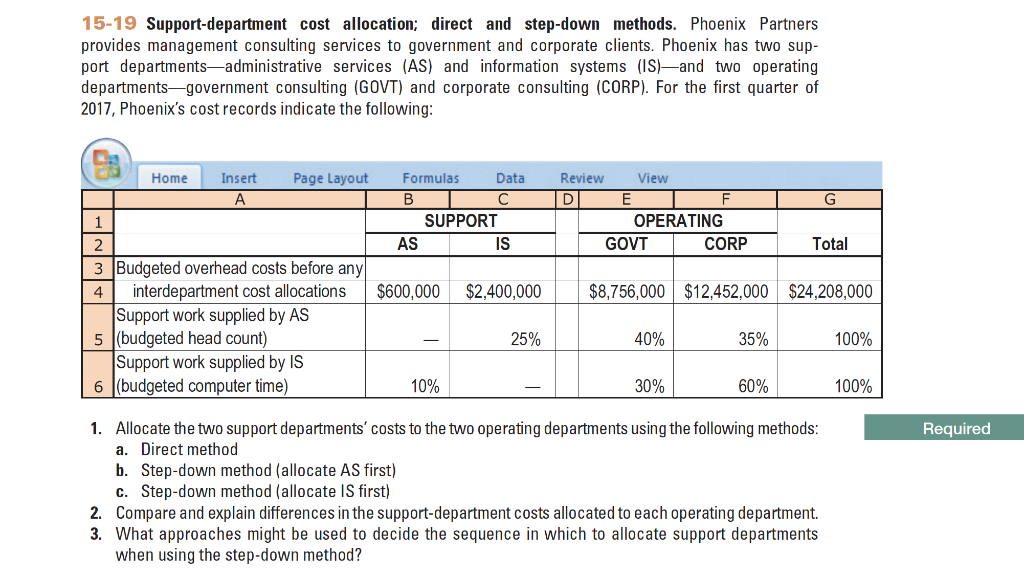

Describe three general methods of assigning costs to products including one stage and two stage approaches.4. Discuss the circumstances under which each of the methods referred to in learning objective 3 will provide accurate product costs.5. Describe the direct, step-down and reciprocal methods of allocating service department costs to producing departments.6. Solve stage I cost allocation problems using the three methods referred to in the previous learning objective.7. Compare dual rate and single rate methods for stage I cost allocations.8. Solve cost allocations problems using the dual rate and single rate methods.9.

What are common mistakes people make when allocating costs?

Typical cost drivers include direct labor hours, machine hours, or units produced. Cost drivers serve as a measure of resource consumption and establish an ongoing basis of measurement for the cost pool. So the hours incurred by administrative departments such as payroll, purchasing, accounting and HR, would be allocated, based on the number of hours worked in each of the operating departments and allocated accordingly. In process costing, all of the processing departments are classified as operating departments.

Accurate Product Cost

Firstly, we can setup the overhead re-apportionment process as a set of equations. Describe the types of relationships between the departments within an organization. These entries reduce cost of goods sold by $75 which is the net amount received from the by-product sales. Each of these equations includes two unknowns, thus determining S1 and S2 requires solving the equations simultaneously. Although simultaneous equations are notnormally solved by hand in practice, one method is presented in Exhibit 6-6 to illustrate the concept.

Methods of Cost Allocation

Cost pools are essentially aggregations of individual costs that relate to a specific task or factor. They play an essential role in simplifying the cost allocation process. Rather than assigning may individual costs to specific products, services, or departments, firms organize these costs into cost pools that can be allocated based on a common denominator – the cost driver. This approach is best used where some service cost centres provide services to other service cost centres, but these services are not reciprocated. Cost centre C serves centres D and E, but D and E do not reciprocate by serving C. In these circumstances the costs of the service cost centre that serves most other service cost centres should be reapportioned first.

If certain costs have little variability, regardless of changes in the driver, that driver may not be appropriate. There are several methods of cost allocation that organizations can employ, each with their own merits and applications based on the specific circumstances, requirements, and objectives of the business. Variable costs are allocated among departments or projects based on how much of each cost driver they use. Fixed costs are allocated among departments or projects based on how they benefit each area.

Regular reviews and audits, coupled with the use of technological tools for data collection and analysis, can further enhance the accuracy and relevance of cost allocation in an organization. Inaccurate estimations can lead to over or under-allocation of costs. Cost allocation in decision making is integral to multiple areas of a business. A few of these areas, such as pricing, budgeting, and investment decisions, leverage cost allocation traditional vs contribution margin income statement definition meanings differences heavily. For example, if your company produces two products, A and B (and each product has its own direct labor cost), you would first need to determine how many units of Product A are produced for every unit of Product B sold. For example, comparing the cost of producing one product versus another can help decide which should be produced more often based on its profitability compared with other goods or services offered by a company.

This can provide a more relevant basis for operational and tactical decision-making. Likewise, if a service-based organization incurs more costs due to labor, ‘labor hours’ could serve as the key cost driver. Firms need to ensure that chosen cost drivers reflect a degree of variance.

By allocating costs following these categories, companies are better positioned to price their products accurately. For instance, in direct material cost allocation, a manufacturing company can include the expenditures related to raw materials required to produce a particular product. These assumptions may not always hold true and can lead to inaccurate cost data.

For example, the assumption of cost homogeneity in a cost pool may lead to inappropriate allocations if the costs in the pool are driven by different activities. Cost allocation affects budgeting, virtually shaping every financial decision a company makes. Businesses, with clarity on cost division across departments, processes, or products, can plan budgets more effectively. They can identify which areas are cost-intensive and adjust the budget proportionately. Without the right cost allocation, a budget may not accurately reflect the financial resources needed or generated by different business segments. The use of reciprocal allocation is recommended in situations where an organization has service departments that provide significant amounts of mutual services to each other.